Conversational Banking and Chatbot and Artificial Intelligence solutions are the new way to:

Reduce in-bound traffic by automating 24-hour assistance

Improve Customer Experience

Manage requests better and reduce Customer Care costs

Collect customer insights and improve Customer Satisfaction

RESPONSA FOR THE BANKING SECTOR

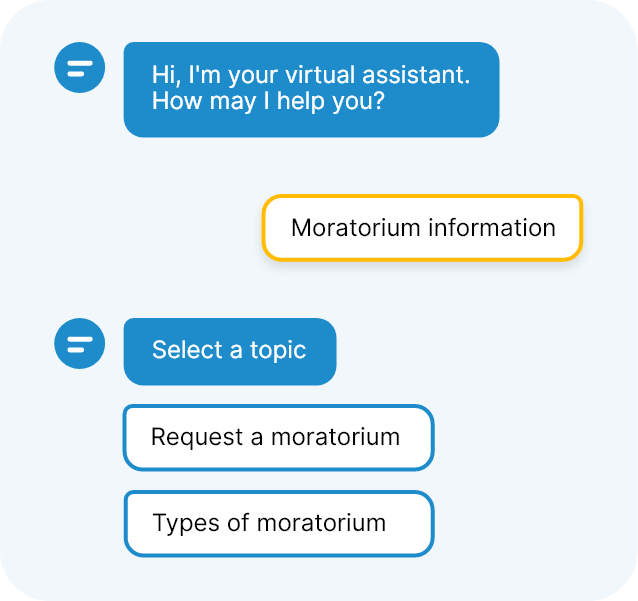

ChatBot and banking: Conversational Banking

Dialogue becomes the tool to interact with the customers, support and guide them in their requests 24/7 with the Responsa ChatBot, thereby significantly reducing assistance costs and waiting times and reducing the number of frequent and repetitive requests made to Customer Service.

A scalable virtual assistant that can be integrated into various channels, which will allow you to manage an unlimited volume of requests 24/7, improve your customer experience and increase your ROI.

Value your customers' time

1.

Zero waiting times

The user can communicate naturally with the ChatBot, receiving immediate answers and support at any time 24/7, without having to wait.

2.

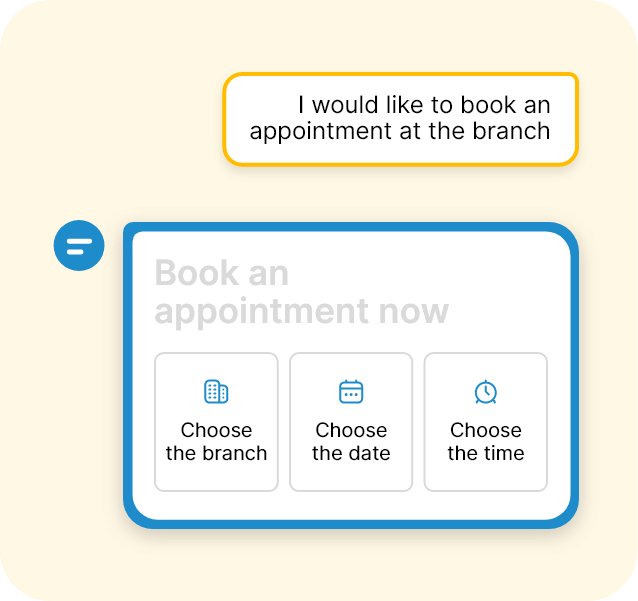

Automatic management of appointments and procedures

The user can book an appointment at the branch directly via chat, and be guided by the ChatBot through other simple procedures that can thus be easily automated.

3.

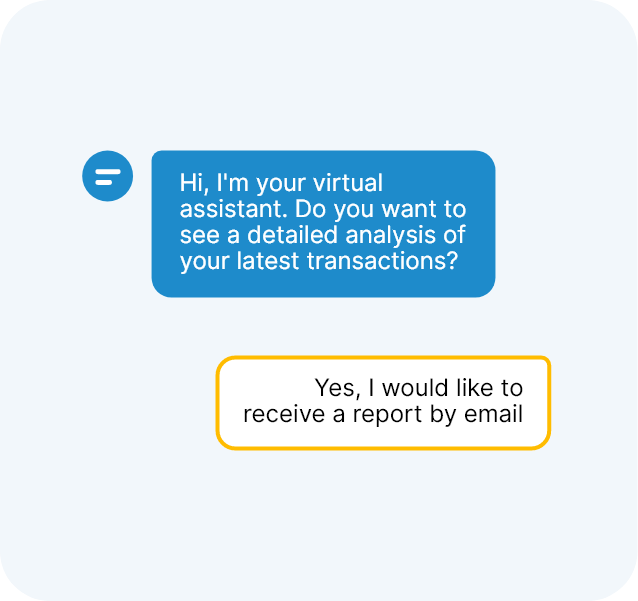

Tips and suggestions from the bank via chat

ChatBots are no longer limited to responding to user questions in a passive manner. They are now proactive and create conversation flows and interact with interlocutors, providing suggestions and advice, helping the user to find the most adequate solution for their needs.

4.

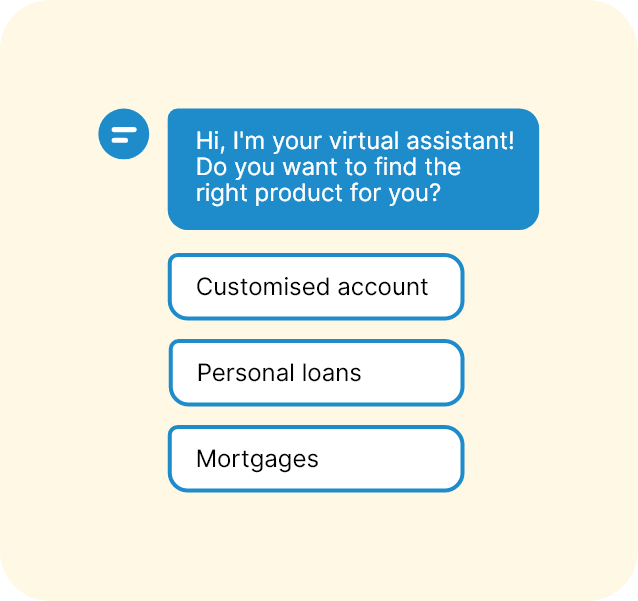

Lead generation

ChatBot is the best way to generate customer leads. In fact, leads come into direct contact with your products and services, allowing you to get to know potential customers and therefore improve the customer experience, brand awareness and your ROI.

A bank closer to the people

5.

Chat with your customers on Whatsapp

Talk to your customers on the most popular and used communication channel. Assist and advise your customers in an easy, fast and automatic matter that is simultaneously direct, informal, private and customised, establishing a close, safe and trusting relationship.

6.

The bank goes social

Place your virtual assistant on social media and bring your branch even closer to your customers. They will also be able to contact you for advice, assistance and support via the most popular and used communication channels in the world.

7.

Get to know your customers better

The interaction between your users and ChatBot will allow you to collect valuable insight to learn more about your customers and their needs. Therefore, you will be able to implement effective and targeted strategies to improve your customer experience and increase the ROI.

Reduce in-bound traffic

and Customer Care costs

8.

Automated management of requests

ChatBot can respond automatically and in real time to the most frequent and repetitive questions of users at any time and in any place they may be, using an intelligent knowledge base created from the actual customer needs.

9.

Free up the call centre and reduce assistance costs

The automated management of requests allows the Customer Service operators to be free to manage more complex issues, thereby resulting in lower management costs and more effective customer assistance, significantly reducing waiting times.

BLOG

You're in good company

They chose Responsa to improve their business